Last week, though busy, was so much easier as I worked normal hours. Today is the second weekend that I’ve not had to work all weekend. I do have to do into one client and get a couple of things done. I had to ask Client 1 for some forbearance so that I could work on Client 2’s ‘stuff’ that was urgent.

I helped with a dog run yesterday—meaning I gave a hand rather than drive. I’m glad I gave a hand, they needed it. Now that we are in the hot/humid months of VA, it is hard work….and hard on the animals too.

Last evening we were invited to a birthday party for a dog—Gilly. His owners are a lovely young couple. Mark works at the same school as the wife who is an art teacher their. They are both outgoing and very active people. Part of the invitation was to bring a dog. We elected to bring Macy our American Bulldog mix.

There was quite a mix of dogs there. Gilly’s two brothers were there. They were part German Short-haired Pointer and Lab—a good looking set of fellows with the GSP coloring and the lab disposition. There were Chihuahuas, Dachshunds, and a cornucopia of other breeds. Jackie had a professional photographer there, so hopefully I’ll see some pics. I didn’t take my own camera, so I’ve nothing to share.

All the animals got along terrifically, and I was proud of Macy. She was a little nervous at first, but not frightened. It was a lot of fun, and I was glad that we were able to take Macy out. As we live where our dogs can get plenty of exercise, I don’t have to take them out to other places.

I finally converted my husband’s old SEP IRA into a brokerage account. The mutual fund model for investing just doesn’t make any sense for my investing style. I’ve kept his money safe in the bear market. I elected to put 1/2 in the FHKCX at the buy point noted above.

I sold on the gap up—I just saw so many of the sector charts stopping dead in their tracks, I didn’t want to press my luck. His account is already up 25% for the year just on two positions. To EXIT this position, I had to pay a short term redemption fee.

From a technical perspective, I’ve sold a position showing obvious strength. I may have overthought the position and have let my bias get in the way with chart work. There are no volumes on mutual funds, so let’s look at a proxy—FXI

I try to pay attention to volume, and more importantly divergences. While stock prices can fall merely on their own weight, volume is needed to propel a stock upwards. This volume pattern is a bit of a conundrum to me. Why? Because the volume now is QUITE heavy relative to the earlier rise in this ETF. I expect a pull back, and I’ll likely re-enter, but I wanted to preserve some profits. NOw, I’d like to show you something dumb ass that I did…..

Here’s an 11 cent stock that I bought. See that massive spike. Somehow, while I was at work that day, I was compelled to check that stock just at that time it was hitting .35. I failed to just hit “sell”. It would have been a very nice profit. Funny, I’ve had the best luck with penny stocks this year. I don’t generally buy them….but a chart is a chart. Gary Kaltbaum started out selling penny stocks.

Making decisions in the market has more to do with quelling one’s natural emotions---a nice gain can dissipate into status quo in the span of just a few minutes. My first response was “Oh WOW, something exciting is happening, and there is news that I don’t know about that is BIG…..I’ll just hang on.” Yeah, right. It did happen to be the last day they were listed (they are now on the PINK sheets).

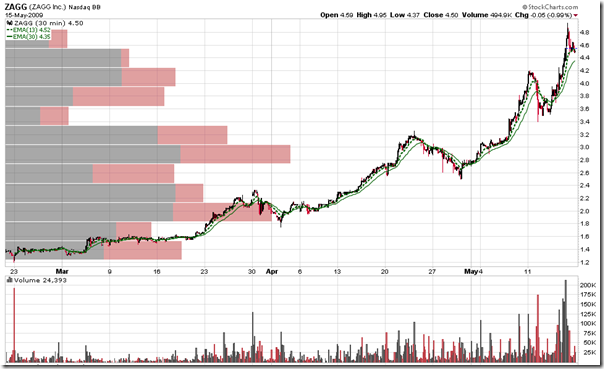

Here’s a chart that I wished I had found.

My preference is to be in a position before the move. I’m not good about chasing moves either higher or lower. In fact, my best success this year has been from being patiently in positions and then have them move. However, when the move gets made (a la PDRT) you have to part with it. Sigh…..

No comments:

Post a Comment