I'm on my final day of slumming. I was going to take a brief nap yesterday. I find an afternoon nap a terrific luxury. In fact, I seldom sleep as well as I do in taking one of these naps. Oh...and it's not a cat nap, "power nap". It's generally a 1-1.5 hour nap. And when I wake up, I'm awake.

My three dogs seem to enjoy these naps. Unfortunately, Daisey was so excited she took her paw (and she has big feet) and managed to hit me in my eye. Luckily, there was no abrasion because of the beauty of our blink. However, but I had about an hour where I was having some real discomfort, and I was wondering whether my eyeball had been pushed to far back in its socket. The worst of it passed...but there went my nap!

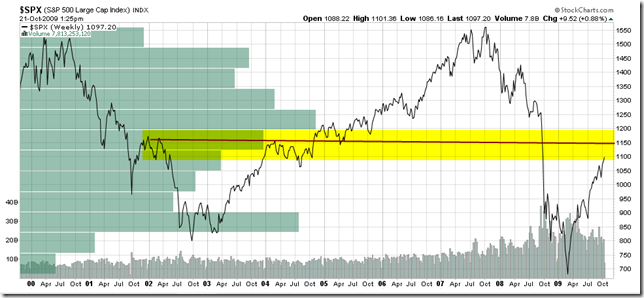

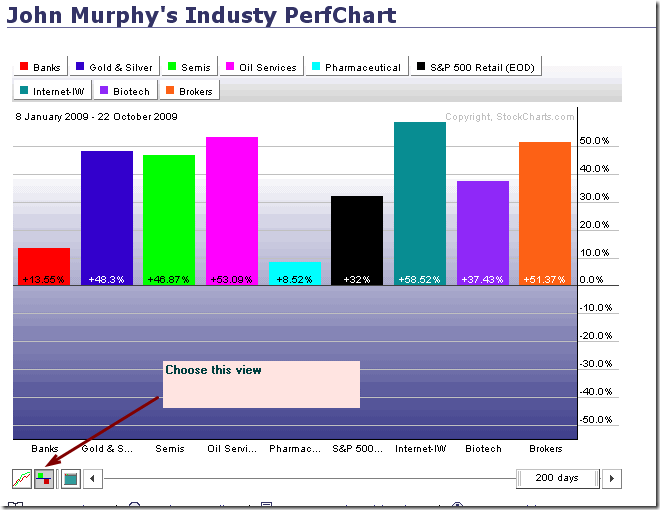

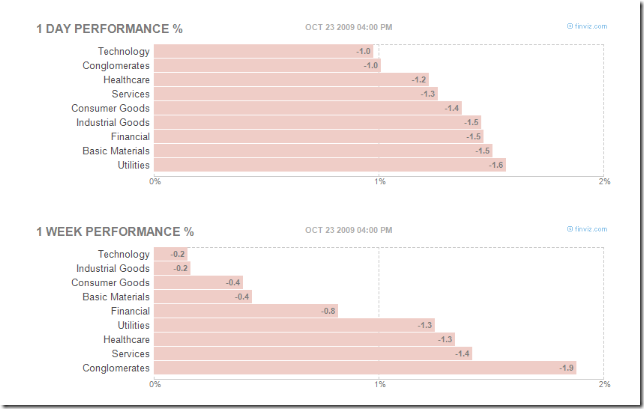

I did not have a chart free day yesterday, rather, I looked at a few charts (but not TOO many). I wanted to share a few with you. The market is getting a little jiggy, and you know that I do not give recommendations on stocks. But this is a blog all about sharing my process (the good, the bad and the ugly). You should know, though, that I don't always publicly crow/lament about all the good/ugly, but I do try to to give some representations of both.

Here are some charts...remember to click to make larger.

Here is my WH...my little Chinese tubular steel maker. This stock is fixin' to get ready to do something. I've a few shares of this, and of course I'd like for that direction to be up.

Now you might be mumbling, "Leisa, just use a stop".

See the image above....If a stock gaps mightily, then your stop is pretty useless. It works for very liquid stocks. Many of these stocks that I am in are not that way. I'm not saying that you should not use stops. Merely, if you use them, understand that you can still get a huge loss. First your stop has to be triggered. Second, there's a minor issue with it needing to be filled. In fast moving market, your fill may be a long way down the price road.

The next one (another Chinese stock..you know I look at these charts most weeks!) is ORS. I've no position in this stock.

In a discussion on SOH, water treatment was mentioned. I was reminded of MWA, and I created an updated chart:

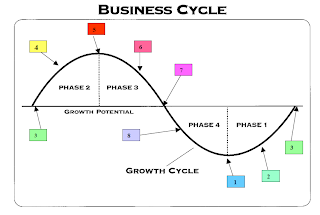

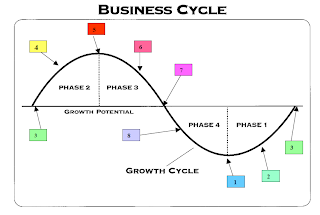

As we know, nothing in a chart can tell us about the future of stock direction with any certainty. But charts yield clues as to price performance, volume patterns, price/volume patterns (e.g. support, overhead supply). I'll go to my grave still peeking at fundamentals. I do care about them secondarily. So I'm not a purist practitioner of either fundamental or technical analysis. But if we are doing anything at all it is evaluating the weight of the evidence. Some passing understanding of the company's fundamentals helps inform of potential knowable risks (bankruptcy, patent expirations, drug trials, economic pressures). And you ought to have an idea of where the business cycle is and whether this stock is in the mature phase of that cycle or not. For regular as clockwork, money moves through those cycles.

Here's PeterDag's business cycle

If you click on the graphic above, you'll see his PDF explaining this cycle. It's important information to understand....you do not want to buy good companies in cyclical industries late in their cycles.