Time to reflect on some past charts and look at some new. Prospections is not a word, but I think it ought to be. When I started this blog, I was sure that there was a word for “perplexion”…..I call it an agent that perplexes. Language would never evolve if folks did not feel some freedom to add words to the lexicon. Now that I’m back to writing a bit more, I’m going to exercise that free will!

For UNG I suppose that many of the folks that bought when I thought there was no one left to sell were the ones that were remorseful sellers. Much has been written about the vagaries of UNG. I’ll not repeat them here, but I’m still holding this though I bought at magenta.

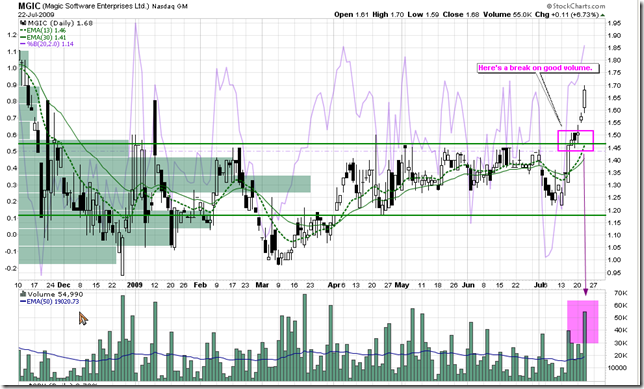

Magic Software. This stock can be called nothing but thin and speculative. As they are holding a boat load of cash and are recently profitable and are breaking out of an important range, I bought some in an extended price jump that I normally wouldn’t jump into. If FINVIZ is to be believed, they have $1.13 in cash per share. Seems pretty low risk to me—see but see my UNG comments above!. Click on their name to be transported to their website.

Here’s a longer term chart

A trio of observations. First, here’s a good example where money can be dead as a hammer for a long time. Second buying and holding through a bubble (witness the nose bleed levels of 2000) is goofy. Third, look at the base in this stock.

Bottom Line Technologies…..here’s an interesting chart—another former glory turned gory in 2000 tech bubble. I’m beginning to wonder if tech—not big cap tech so much—but small cap tech may be coming into a resurgence. I’ve no position here, but you might put them on a watch list.

No comments:

Post a Comment